Our Services

.jpg)

Drinking Water Supply

Building and operating drinking water treatment plants and laying pipelines for supplying safe drinking water to taps across the country.

Read More

Waste Water Treatment

Building and operating sewage treatment plants for treating waste water to ensure health and safety of the country’s population and water bodies.

Read More

Waste Water Reuse

Partnering with government and industries to re-use treated water for commercial purposes and help build a sustainable water cycle in the country

Read More

Automation and O&M

Operation and maintenance of treatment plants along with investments into new water related technologies and processes to increase efficiency.

Read MoreOur Projects

50 MLD Water Reuse Project in Chandrapur

Augmented Sewage Treatment Plants to match quality of treated water for Thermal Power Station, saving 50MLD water for city residents

Read More

Water and Sewerage facilities in Maldives

Working with Maldives Ministry of Planning, Housing, and Infrastructure to augment water and sewerage network for 6 islands

Read More

Smart Metering in Mumbai

Working with Municipal Corporation of Greater Mumbai to automate and centralize control of city's water assets

Read More

200 MLD STP with 190 MLD Reuse project in Nagpur

Worked with Nagpur Municipal Corporation to develop 200MLD STP and India's largest re-use facility for thermal power plants

Read More

NMCG Maheshsthala

Working with NMCG to develop 35 MLD STP at Maheshtala, Kolkata along with its maintenance for 15 years

Read More

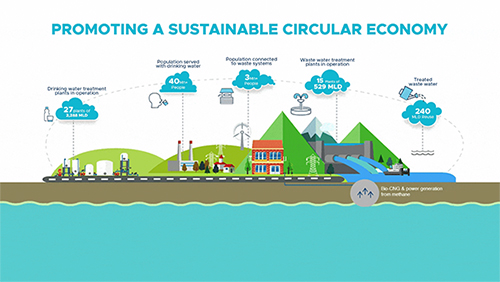

Our Impact

Testimonials

For Nagpur 200 MLD STP

The water is not only being treated but is also being reuse through this project in Nagpur. If other cities replicate this project there will not be any struggle to augment the water sources for the city for many years.

Basavakalyan 24x7 Water Supply

Due to this 24x7 water supply project, now the people have a lot of time for productive works which will help them improve their life

For Nagpur 24x7 Water supply

We get continuous water and we are very happy, we got what we wanted – regular water supply at our home.

For Nagpur 200 MLD STP

The best aspect of the project is that we get share from the sale of treated water and it will become a self financed project if the operator is able to sell entire 200 MLD water. It not a technology centric project but it is a human centric project as a man cannot live without water and making people aware that saving every drop matters makes this project human centric.

Shravan Hardikar - Commissioner, Nagpur Municipal Corporation

For Nagpur 24x7 Water supply

The city had varied water supply from alternate days in some areas to 12 hours a day in some areas, we are happy to achieve equitable water supply throughout the city from initial implementation of Nagpur 24x7 Water supply project.

Shri Pravin Datke - Mayor, Nagpur

For Nagpur 24x7 Water supply

We have achieved equitable water supply for the city through Nagpur 24x7 Water supply project.

For Nagpur 24x7 Water supply

This project has benefited us, our children by getting water to our doorstep. The fight over water has stopped as now we have tap at our door and we can use it whenever we want.

Basavakalyan 24x7 Water Supply

Earlier, city had very less water supply and people had to put in lot of time for such a basic necessity. This project has allowed them to use their time in productive works

Shahabad 24x7 Water Supply

24x7 water supply project has not only benefited the local government body but also the common man which is the most important thing

Bidar 24x7 Water Supply

This Scheme has enhanced the livelihood of Bidar citizens to a great extent

For Nagpur 200 MLD STP

The project has so many benefits for the city – NMC does not have to invest into the project, untreated water gets reused and curbs the pollution in the city water resources and STP generates revenue for NMC.

Recent News